Think of a task that is both complex and menial, a simple responsibility once mastered, but an obligatory waste of time and energy when burdened with it, especially when it takes up a good portion of your day when you could be doing something else much more productive. Does this sound like driving to and from work to you? Imagine if you had no choice but to commute to work by driving every day. What would be the economic benefit if that necessary but cumbersome task was replaced by a fully automated self-driving vehicle? Now imagine both the mental and physical relief you would experience from being absolved of this task. During the commute, you could dedicate this valuable time to catch up on emails, read the news, or strategically plan out your workday. Self-driving automobiles are still a work in progress…but they are coming.

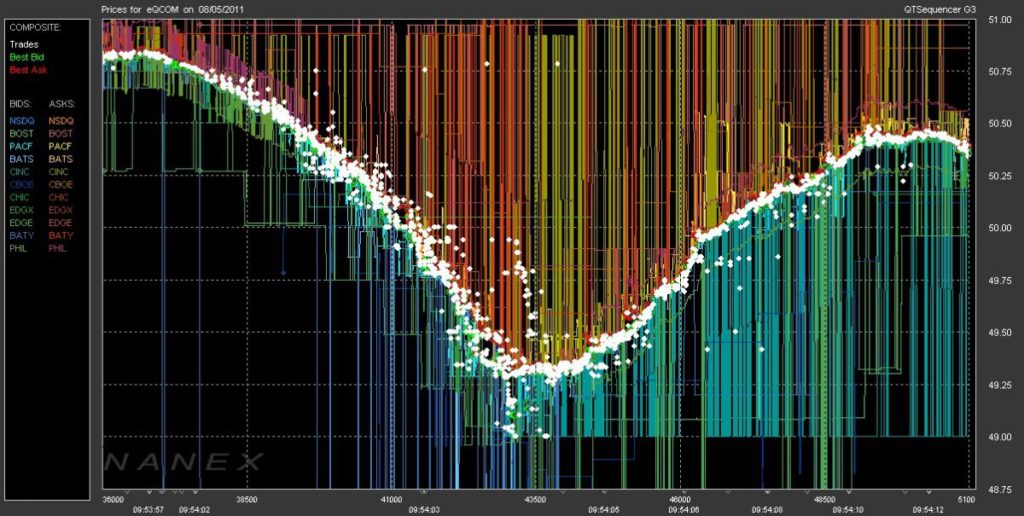

Now can you think of some responsibility in trading that is akin to the necessary but mindless task of driving to work? For most option trading desks, the obvious choice is the required management and maintenance of all IV curves and skews, which determines the theoretical values on your Trade Sheets. How do most traders calibrate and set their IV curves and Trade Sheets? They painstakingly drag and click multiple control points on a static vol curve, utilize an inaccurately implied fit function, or manually enter numerical parameters through trial-and-error, all intended to closely match the market’s bid/ask midpoints in some semblance of a smooth smile. Given how fast and violently IV, skew, and term-structure can fluctuate, this can be an excruciatingly slow and tedious undertaking, filled with errors and imprecise estimations, often leaving you hopelessly frustrated with the whole process. However, timely and accurate calibration of your IV curves and theoretical prices can be considered the most essential component of your trading operation, on par with inventory and position risk management, and even actual trading itself. Mid to large-sized trading groups often have one or two IV surface managers who are assigned with the sole task of managing and maintaining the multitude of IV curves actively traded and monitored by the option group’s traders. An S&P 500 group alone can have 50+ different IV curves to monitor and adjust. This would include all monthly serial and quarterly expirations, as well as all actively traded weeklies for the S&P 500 complex – SPX, E-mini S&Ps, SPY, and VIX. That’s an insane amount of curves to manage maintain by hand!

Like driving, the task of maintaining and managing your IV curves and Trade Sheets is both complex and routine-like, can take a long time to completely master, but in the end, it is a waste of valuable time and energy if it can be fully automated. AI functioning vehicles are not yet commercially available, but a fully automated curve fitting algorithm is currently available in the pioneering Dynamic Skew® algo. In today’s unforgiving, cutthroat, algo-driven trading environment, smart automation of any menial task will dramatically improve the efficiency of your trading operation, and reallocate wasted human capital to more productive tasks such as monitoring for trading opportunities or managing inventory (which is another candidate for automation).

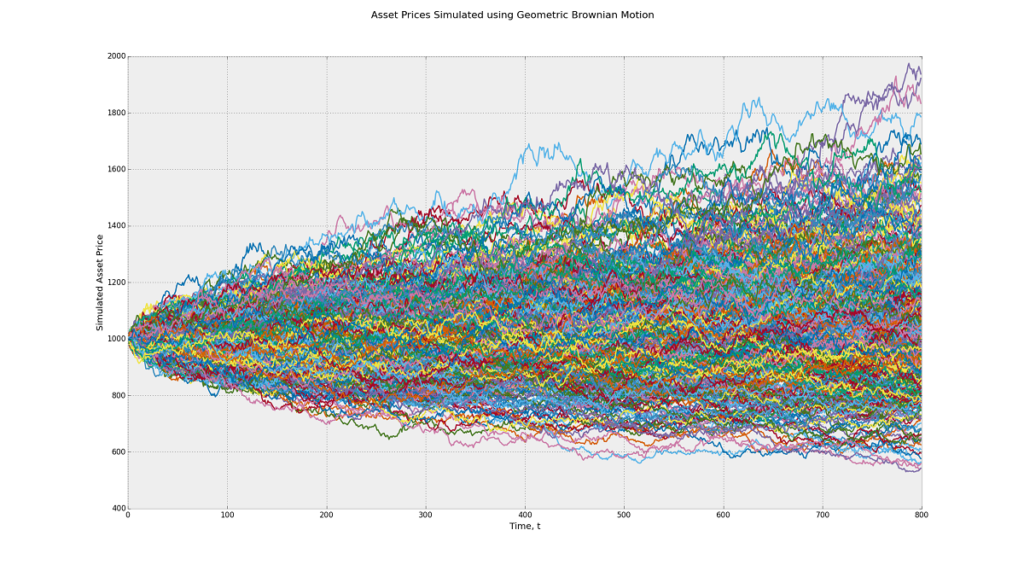

The Dynamic Skew® algo fits the very definition of smart automation. The algo can do the job of 2 IV surface managers with blinding speed and superior precision to its human counterparts. It can simultaneously update and publish all your curves as frequently as once every second. In addition, the Dynamic Skew® algo allows you to customize the smoothness, evolution, and variability of all your IV curves. Let’s say you trade the relatively low vol US 10 Yr Note Treasury options. Given the relative static-ness or “stickiness” of 10-Yr Note option IV curves, the Dynamic Skew® algo allows you to increase the stability and rigidity of your IV curves through the innovative “curve_stabilizer” and “dynamicity” features (see PDF user manual for more detail), in order to reflect their static nature. For more volatile products such as the SPX (S&P 500) and WTI Crude oil, you would run lower “curve_stabilizer” levels to provide faster responses to changes in IV, and higher “dynamicity” levels to permit new IV curve shape. Both features along with the curve frequency can also be customized to fit general market conditions: higher responsiveness and faster evolution for volatile and wide range market conditions, and vice versa for calm and range-bound environments. These 2 essential features allow the user to customize the behavior of their IV curves to reflect the relative “vol of vol” nature of the options, as well as the volatile nature of the underlying instrument.

To control levels of smoothness, the Dynamic Skew® algo employs a proprietary “Outlier Removal Logic” (ORL) feature along with a supplemental “smoothing_amount” function that smooths out pricing anomalies and biases in your IV curves. You can have ultra-smooth curves with high levels of ORL and “smoothing_amount”, or on the other side of the spectrum, more “bumpy” or “jagged” curves to reflect market biases, which can be useful for when strikes behave independently of each other as they often do close to expiration. The Dynamic Skew® algo ensures your IV curves are objective and unbiased (by the user), always reflecting the collective opinion of the marketplace.

What can smart automation in the form of the Dynamic Skew® algo do for you and your trading operation? It opens the door for new trading ideas derived from pattern recognition, and the discovery of predictive market behavior based on the accurate IV market data generated by the Dynamic Skew® algo. The robustness and precision of the Dynamic Skew® algo permits applications such as the complementary VolLevels™ algo to produce critical and reliable IV market data needed to identify fleeting trading opportunities and mispriced anomalies on the IV surface. The Dynamic Skew® algo all but eliminates any worries of having mispriced Trade Sheets, preventing you from being victimized by violent moves in IV, skew, or term-structure. A number of essential safety features are embedded to minimize any bad curve publications during extreme market conditions or a liquidity crisis. This frees you up to expand and improve upon your trading acumen, advance your inventory and position management skills, experiment with new trading ideas and approaches, master the art of forecasting vol, “front-running” anticipated paper flow, etc.

Smart automation employed by the Dynamic Skew® algo dramatically improves the efficiency of your trading operation. It can address one of your most pressing needs to always have accurate and timely theoretical prices, as well as eliminate the inferior utilization of human capital. But most of all, the Dynamic Skew® algo frees up your valuable time and energy, allowing you to expand your trading horizons, pursue data-driven “holy-grail” trading strategies, and push the envelope as a trading operation…resulting in the maximization of your profit-making potential.