FAQs for Dynamic Skew® & VolLevels™ Algo

How can your algos help me make money trading?

What are the fixed costs involved to run one or both algos?

How can your algos help me make money trading?

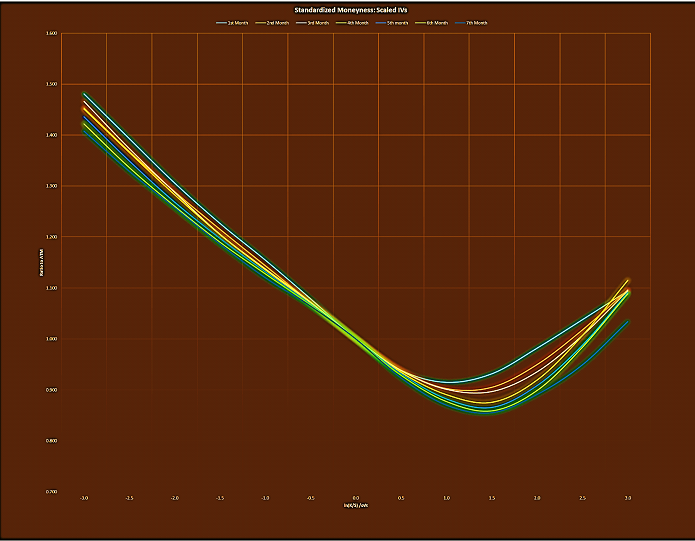

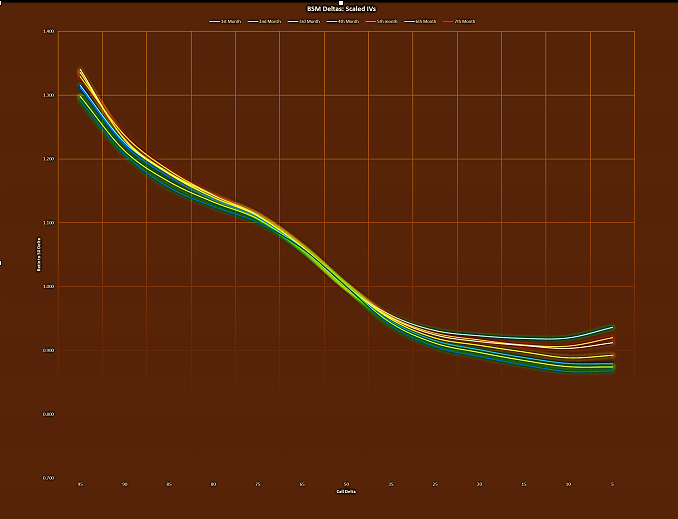

The Dynamic Skew® algo is not a trading system or program. The cutting-edge algorithmic application is instead an innovative automated volatility curve fitter and theoretical pricing tool designed to dramatically improve the efficiency and performance of your trading operation. Not only does the algo fully automate the painstaking and time-consuming task of maintaining, updating, and calibrating your IV (implied volatility) curves and “Trade Sheets”, it also helps prevent you from being “run over” or “picked off” during violent IV and/or skew movements in the smile. These critical benefits all lead to a more streamlined and consistently profitable trading operation.

The VolLevels™ algo, the ideal companion to the Dynamic Skew® curve fitter algo, is an implied volatility analytics tool that helps you efficiently spot high probability trading opportunities, and prevents you from partaking in seemingly “good” trades that end up being losers due to mispricing in the marketplace. Combined with the precision and accuracy of the real time implied volatility data produced by the automated Dynamic Skew® curve fitter, the VolLevels™ algo is an invaluable trade navigation guide that can help you avoid losing trades and generate significant alpha with high probability ones.

What are the fixed costs involved to run one or both algos?

The Dynamic Skew® algo is currently being licensed out at $1,200/month. The VolLevels™ algo, which works for both automated and manual curve adjusting, is priced at $500/month. We are currently offering a combination package deal where you can get both algos at a discounted $1,450/month.

Considering that many trading desks have one or more people assigned to the sole task of maintaining and managing all volatility curves around-the-clock, the Dynamic Skew® algo can actually eliminate this inefficient use of human capital, which can save a trading group a significant amount of operating overhead. In addition to permanently cutting costs, the Dynamic Skew® produces much more accurate theoretical values, and at speeds many times faster than its human counterpart.

What are the advantages of using either algo?

Where can I purchase or subscribe to one or both algos?

What are the advantages of using either algo?

The fully automated Dynamic Skew® curve fitter algo produces high quality, worry-free implied volatility (IV) curves when there is sufficient bid/ask market data, publishing curves as often as once every second. This allows you to focus your time and energy on important high-level tasks such as position risk management and volatility trading strategy. Because the Dynamic Skew® algo is capable of precisely modeling any curve shape, it can produce bias-free volatility curves even where model skew types with limited control points experience problems.

The VolLevels™ algo organizes the chaos and cumbersome IV market information on your “Trade Sheets” to produce efficient, easy-to-read market data tables which allow you to quickly spot relative value opportunities and pricing anomalies on the smile and IV surface. The algo also tracks IV level changes and their corresponding intraday ranges. The VolLevels™ algo additionally monitors skew and kurtosis measurements that allow you identify overbought and oversold conditions on the individual smiles and IV surface.

Using both of these complimentary algos together can create a significant trading advantage over your competitors.

Where can I purchase or subscribe to one or both algos?

The Dynamic Skew® and VolLevels™ algo are currently available on Vela’s (formerly OptionsCity) Metro Store Front. One must be a subscribed user of Vela’s Metro trading platform to have access to one or both algos.

Here is the link to Vela’s Metro Trading Platform:

https://tradevela.com/products/software/trading-platform/

Here is the link to Vela’s Metro Store Front:

http://citystore.optionscity.com/storefront/market

If you are currently a Metro user you can simply contact your account manager, Gregg Cooper at (312) 605-4533 to obtain a free trial of one or both algos. We are currently offering free 30 day trials for both the Dynamic Skew® and VolLevels™ algo.

To be eligible for the free trial, you must first switch to or subscribe to Vela’s Metro Trading Platform. Please contact Patrick Gardner, Director of Sales, for inquiries about the Metro Trading Platform at O: (312) 605-4525 or M: (312) 662-8975.

Can your applications work on more than one or more similarly traded products?

How does the Dynamic Skew® algo perform during busy markets? Is it able to handle extreme market conditions?

Can your applications work on more than one or more similarly traded products?

Absolutely. We currently have a number of trading groups who use one or both of our algos to trade a large portfolio of similarly traded products. For example, one of our S&P 500 trading desks currently utilizes the Dynamic Skew® curve fitter algo to fully automate the maintenance and generation of 40+ individual implied volatility (IV) curves which include all monthly, quarterly, and weekly expirations for options in the SPX, e-mini S&Ps, SPY (“Spiders”), and VIX futures.

In the VolLevels™ algo, traders can align similar products such as soybeans vs corn side-by-side by simply creating a new job instance window for each product. Viewing different IV surfaces side-by-side has never been easier.

How does the Dynamic Skew® algo perform during busy markets? Is it able to handle extreme market conditions?

The fully automated Dynamic Skew® curve fitter has gone through rigorous beta testing in all types of market conditions. It has been painstakingly engineered to handle the most volatile and illiquid market environments. The curve fitter algo has many embedded safety features (see PDF user manual for more detail) designed to minimize “undesirable” curve publications and produce the most reliable and accurate volatility curves during times of crisis and lack of liquidity.

However, if there is very wide, one-sided, very little, or no bid/ask market data, the Dynamic Skew® algo will not have enough information or “good data” to produce a reliable volatility curve. Fortunately as one of the safety features, the algo will resort back to the last known quality curve via a recorded “master pattern”, which provides the trader the best available “fair value” theoreticals during a liquidity crisis.

How easy are both algos to configure and set up? Does implementing either algo require significant changes to our trading operation?

How easy are both algos to configure and set up? Does implementing either algo require significant changes to our trading operation?

Despite the Dynamic Skew’s comprehensive features and capabilities, the creators have gone through great lengths to make sure the automated curve-fitting algo is as user-friendly and easy-to-learn-and-customize as possible. The user will find using the algo extremely intuitive to use, and conveniently easy to replicate for additional trading products and expirations. Both developer Kevin Reeves and collaborator/beta tester Rich D. will be more than happy to walk first-time users through the set up and configuration, as well as briefly train new users on how to customize the algo’s settings based on product, market conditions, and/or the user’s preferences. Demos in a trader’s product line or asset class are also readily available before going live with the algo. Once configured, the Dynamic Skew® algo job instances need very few modifications and can be left to run uninterrupted around-the-clock with minimal adjustments, fully automating one of your most menial but complex tasks.

After defining a few variable inputs, the VolLevels™ algo is a very simple “plug and play” application which only requires the user to customize the layout of the tables and grids in order to maximize their screen space.

The only significant change the user will experience is the enormous relief from no longer having the arduous task and heavy burden of manually adjusting their volatility curves and “Trade Sheets” all day. In addition, the valuable “feel” of where volatility and tick levels are trading throughout the day obtained by traders through constant manual curve adjustments, is easily replaceable and better quantified through the use of the VolLevels™ algo, which details these implied volatility and tick level changes in real time and with much higher precision.